What Is a PASS? How to Write a PASS Plan in North Carolina (Step-by-Step)

Originally published: November 2025 | Reviewed by Perry Morrison

Disclaimer — Informational Only: This article is for general informational purposes only and does not provide legal or application assistance. Morrison Law Firm does not prepare, file, or assist with PASS plans or PASS applications. Morrison Law Firm does not provide PASS application assistance — the resources listed below are independent.)

A Plan to Achieve Self-Support (PASS) helps people with disabilities save money for work goals without losing their benefits.

This Social Security program lets recipients set aside income for things like education, job training, or even starting a business.

A PASS is a detailed written plan that describes an individual’s career goal, identifies specific items or services they need to achieve the career goal, identifies sources of income or resources to be set aside to pay PASS expenses, and includes steps that the person will take to achieve the career goal with timeframes.

North Carolina residents can use PASS to achieve their career goals while keeping their disability benefits. The state offers special resources to help people create and manage their plans.

A PASS specialist is an independent expert who may help applicants with the PASS application process.

Writing a PASS plan takes careful planning and the right paperwork. You need to show clear work goals, realistic steps, and valid expenses.

The Social Security Administration reviews each plan to make sure it follows the rules and can actually lead to success.

Key Takeaways

- PASS lets people with disabilities save money for work-related expenses without losing their benefits

- North Carolina has dedicated specialists who help residents create and submit successful PASS applications.

- A good PASS plan must include specific career goals, clear steps, realistic timelines, and approved expenses.

What Is A PASS Plan In North Carolina?

A PASS plan helps people with disabilities save money for work-related expenses while keeping their Social Security benefits. The program allows participants to set aside income that would otherwise reduce their benefit payments.

Key PASS Basics

A PASS is a detailed written plan that outlines a person’s career goal and the steps they’ll take to achieve it. The plan also lists the specific items or services required to get there.

Participants must include the income sources they plan to set aside for PASS expenses. The plan needs timeframes for each step toward employment.

What PASS Covers:

- Job training and education costs

- Work equipment and tools

- Transportation to work or training

- Business startup expenses

- Professional licenses and certifications

Any expense that helps someone prepare for, get, or keep a job can be part of a PASS plan. The money saved through PASS doesn’t count against Social Security income limits.

North Carolina residents get to work with specialists who review their plans and offer guidance along the way.

Who Qualifies For PASS—And Does SSDI Alone Qualify?

PASS eligibility requires specific disability and income requirements beyond receiving SSDI benefits. You need SSI eligibility and extra income sources to fund your work goals.

Eligibility Signals

To qualify for a PASS plan, you must meet several strict requirements. Getting Supplemental Security Income (SSI) benefits or becoming eligible for SSI is the main qualification.

SSDI alone doesn’t qualify someone for PASS. But people who get both SSDI and SSI can use their SSDI payments to fund their PASS plan.

The key eligibility requirements include:

- Disability status: Must be a person with a disability or blindness

- SSI connection: Must receive SSI or become eligible through an approved PASS application

- Income source: Must have income other than SSI, such as SSDI benefits or wages

- Assets: May have assets over $2,000 that can fund the plan

- Work goal: Must have a realistic employment objective

SSDI recipients who don’t receive SSI can’t participate in PASS programs. The program targets people with limited resources who need help saving for work-related expenses.

If you’re ready to get started, call us now!

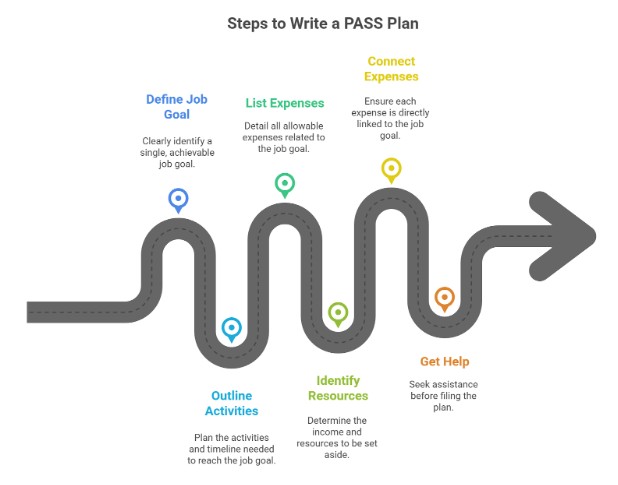

How To Write A PASS Plan In NC (Step-By-Step Using SSA-545)

Writing a PASS plan means completing Form SSA-545 with specific details about your work goal, timeline, and expenses.

You must show how setting aside income will help you reach a feasible employment goal within a reasonable timeframe.

Step 1 — Define A Single, Feasible Job Goal

My employment goal is to become a ________________.

This job requires the following certification/education: __________________.

After completing training, I expect to earn $____ per hour working ____ hours per week.

Good employment goals include:

- Certified nursing assistant at ABC Medical Center

- Licensed real estate agent in Charlotte

- Owner of a small catering business

- Computer repair technician at a local shop

The work goal should fit your abilities and the local job market. Social Security checks if the goal makes sense based on your education, work history, and disability.

Key requirements:

- Must be one specific job or business

- Should provide enough income to reduce SSI dependence

- Must be doable within the proposed timeline

- It can’t be something you already do

The employment goal anchors the rest of your PASS plan.

Step 2 — Outline Activities & Timeline

This section needs a detailed schedule showing when each activity will happen. The timeline should be realistic and specific.

Sample timeline structure:

- Month 1-3: Enroll in community college program

- Month 4-12: Complete required coursework

- Months 13-15: Take certification exam and job search

- Month 16: Start employment

Most PASS plans run 18-48 months. Shorter plans make sense for simple goals, such as buying work tools, while longer plans work for education or training programs.

Each milestone needs a clear deadline. Vague timelines like “sometime next year” won’t work. You have to show you can actually finish each step.

Timeline considerations:

- School enrollment periods

- Licensing exam schedules

- Equipment purchase timing

- Local hiring patterns

Before approving your PASS, the reviewer checks these exact items:

Step 3 — List Allowable Expenses

Only certain expenses qualify for PASS plan funding. Every expense must directly connect to your work goal.

PASS Expense Table (What Counts vs. What Doesn’t)

| Category | Examples (Allowed) |

| Education / Training | Tuition, books, lab fees, certifications |

| Work Equipment | Tools, uniforms, computer, software |

| Transportation | Car payment, insurance, gas, repairs |

| Business Startup | LLC formation, website hosting, and advertising |

| Support Services | Childcare, job coaching, assistive tech |

| Not Allowed | Reason |

| Rent, groceries, utilities | Regular living expenses |

| Entertainment costs | Not tied to job goal |

| Debt payments | Not part of the PASS objective |

| Expenses not justified in the plan | Must directly support the job goal |

Each item needs an exact cost estimate. Try to get quotes from vendors when you can. If your estimates seem way off, expect questions.

The total budget should be reasonable for your work goal. A $50,000 plan to become a cashier? That’s just not going to fly.

Step 4 — Identify Income/Resources You’ll Set Aside

You need to have non-SSI income or resources to fund your PASS plan. SSI payments can’t be used for this.

Acceptable income sources:

- Wages from your current job

- Social Security Disability Insurance (SSDI)

- Spouse’s income

- Investment returns

- Gifts from family members

Resources that can be set aside:

- Bank account balances above SSI limits

- Stocks or bonds

- Property that you can sell

- Insurance payouts

Show exactly how much money you’ll save each month. For example, “I’ll set aside $200 monthly from my part-time job wages.”

Monthly savings should match your timeline and total budget. If you set aside too little, you won’t cover your planned expenses.

Social Security tracks these funds to make sure you use them properly. You’ll need to keep the money in a separate account just for PASS expenses.

If you’re ready to get started, call us now!

Step 5 — Connect Each Expense To The Work Goal

Every expense you list must clearly support your employment goal. Make the connection obvious and logical.

Strong connections:

- Nursing school tuition → becoming a certified nursing assistant

- Commercial driver’s license fees → truck driving job

- Culinary equipment → starting a catering business

- Microsoft Office training → administrative assistant position

Weak connections:

- General college courses → specific job requiring trade skills

- Expensive car → job accessible by public transit

- High-end equipment → entry-level position

Explain how each expense helps you achieve your work goal. Usually, one or two sentences per item is enough.

Example explanations:

- “Tuition for the CNA program will provide the required certification for hospital employment.”

- “Work uniforms are mandatory for all restaurant staff positions.”

- “Laptop computer needed for online real estate courses and client management”

Social Security may question or reject expenses that don’t seem related to your employment goal. If in doubt, add a short explanation.

Step 6 — Get Help Before You File

PASS plans have many moving parts, and the requirements can trip up first-timers. Getting help from an independent PASS specialist or accredited counselor may improve your chance of approval.

Free assistance sources:

- Vocational rehabilitation counselors

- Disability advocacy organizations

- Social Security PASS specialists

- Community college disability services

- SCORE mentors for business plans

These independent helpers know what makes a PASS plan work. They often review draft plans prior to submission.

Independent helpers and what they can do

Free or independent helpers (WIPA counsellors, VR counsellors, PASS specialists, SCORE mentors) can review drafts, check timelines, and suggest vendor quotes. These helpers are independent of Morrison Law Firm.

Lots of people stay in touch with their counselor throughout the whole process. Sometimes that support keeps going after approval to help track progress or fix issues that pop up.

Your helper really needs to understand both SSI rules and the job market where you live. That combo ensures your plan meets Social Security’s requirements while still making sense for you.

What Expenses Count In A PASS—And What Doesn’t?

With a PASS plan, you can set aside income and resources for work-related stuff. Not everything qualifies, though.

Qualifying PASS Expenses

Most costs related to getting ready, finding, or keeping a job can go in your PASS plan. Education and training are classic examples.

Work-related expenses include:

- College tuition and books

- Job training programs

- Work equipment and tools

- Transportation to work or school

- Job coaching services

- Professional clothing or uniforms

Support services count too—think childcare while you’re at work or attendant care.

Expenses That Don’t Qualify

Pre-existing expenses usually don’t count under PASS. If you’re already paying for something like medication, it might fit under a different work incentive instead.

Non-qualifying expenses include:

- Regular living expenses (rent, groceries, etc.)

- Entertainment

- Anything not tied to your work goal

- Stuff you were already paying for before the PASS

Bottom line? The expense has to help you reach your work goal that’s in your plan.

You’ll want to collect estimates for everything you plan to spend. That way, your budget and timeline are actually doable.

PASS Vs. Other NC Tools: ABLE, IRWE/BWE, 1619(b)

People in North Carolina have several work incentive options to pick from. Each one serves a different purpose and comes with its own unique perks.

PASS vs. ABLE Accounts

PASS plans let you save for work goals. ABLE accounts are broader and cover any disability-related costs. You can use both if your goals line up.

ABLE accounts have yearly contribution caps. PASS plans don’t, but you do need a specific work goal.

PASS vs. IRWE/BWE

Impairment-Related Work Expenses (IRWE) cut your countable income by half the expense. PASS plans cut income dollar-for-dollar.

You can use IRWE on its own or with PASS. If an expense fits in a PASS, you usually get a better deal.

PASS vs. Section 1619(b)

Section 1619(b) lets you keep Medicaid even if you earn above SSI limits. PASS helps you get higher SSI while you work toward your job goal.

Sometimes people use all these tools together. For example, you might use PASS for training, IRWE for equipment, and 1619(b) to avoid losing health insurance.

| Tool | Main Purpose | What It Protects |

| PASS | Fund a specific employment goal | Income & resources |

| ABLE Account | Save without losing SSI | Assets (up to $17,000/yr contribution limit) |

| IRWE / BWE | Deduct work-related expenses from income | Monthly countable income |

| Section 1619(b) | Keep Medicaid after earnings exceed SSI | Health insurance |

North Carolina-Specific Help: Who Reviews PASS And Where To Get Support

Social Security reviews every PASS application. In North Carolina, you can get help from local counselors and specialists who know the ropes.

NC WIPA Benefits Counseling—How To Prepare For The Call

Work Incentives Planning and Assistance (WIPA) programs offer free counseling for North Carolinians. These counselors focus on Social Security work incentives, including PASS.

WIPA counselors walk you through how work affects your benefits. They’ll check your situation and break down PASS requirements. They’re also great at helping you set work goals that Social Security will accept.

Before you call a WIPA counselor, grab these:

- Recent Social Security award letters

- Bank statements from the last three months

- Pay stubs or income records

- Info about the job or business you want

- Estimated costs for training, equipment, or services

The counselor will ask about your income and resources. They’ll want to know your work goal and what expenses you expect your PASS to cover.

WIPA is free. You can meet by phone, video, or in person. Some WIPA counselors may assist with completing or reviewing a PASS application, but they are independent of Morrison Law Firm.

North Carolina Vocational Rehabilitation (VR)

NC VR helps with:

- School enrollment

- Training registration

- Vendor quotes

- Proof of feasibility

NC VR may assist with drafting portions of a PASS plan or providing supporting documentation; confirm the exact scope of assistance with your local VR office. NC VR is an independent agency.

Contacting The PASS Cadre

The PASS Cadre is Social Security’s specialist team for PASS applications. They cover several states and see many North Carolina cases.

You can reach out to the PASS Cadre before you apply. They’ll answer questions about PASS rules and help clear up anything confusing.

The PASS Cadre can help with:

- Explaining which expenses qualify

- Looking over draft applications

- Clarifying work goal requirements

- Discussing approval timelines

They like written questions sent through official Social Security channels. Your local office can forward your questions to the PASS team, which helps create a record for your file.

The Cadre can’t promise approval just because they gave you feedback. Still, their advice helps you avoid common mistakes that can lead to denial.

When to Consider Hiring a PASS-Specialist or Attorney (Informational)

Some PASS applications can become complicated. If your PASS is denied, you plan to start a business, or your situation involves multiple work incentives, you may benefit from professional assistance.

This article is informational only — Morrison Law Firm does not prepare or file PASS plans.

For representation or application help, look for:

- an independent disability attorney who specifically lists PASS or Social Security appeals in their practice, or

- an accredited PASS specialist, vocational rehabilitation counselor, or a WIPA counselor.

These professionals can advise on appeals, complex plan changes, or multi-incentive strategies. Confirm their PASS experience before hiring.

Common PASS Mistakes In NC (And Easy Fixes)

Lots of North Carolina applicants stumble over the same things when they put together PASS plans.These slip-ups can slow down approval or just make life harder down the road.

Missing Required Documentation

It’s surprisingly easy to leave out paperwork. The stuff that goes missing most? Medical records, therapy notes, and teacher reports.

Easy Fix: Try making a checklist before you even start your PASS plan. Gather everything up front, then get to work writing.

Vague or Unclear Goals

Goals like “improve in math” or “get better at reading” just don’t cut it. PASS plans need goals that are specific and measurable.

Easy Fix: Numbers help. Instead of saying “improve math skills,” write “increase math fluency to 40 problems per minute.” Stick a timeframe on it too.

Unrealistic Timelines

Some folks aim way too high for the time they’ve got. Others stretch things out forever with no real check-ins.

Easy Fix: Break big goals into smaller ones. Set monthly or quarterly checkpoints to see if you’re on track.

Ignoring Student Input

Parents and teachers sometimes skip asking the student what they actually want or need. That never helps.

Easy Fix: Bring the student into planning meetings. Ask them about what works for them and where they struggle.

Incomplete Service Descriptions

It’s common to see plans that list services but don’t say how often, how long, or who’s doing what.

Easy Fix: Spell out the details—how often, how long, and who handles each service or accommodation.

Note: This article is informational only. Morrison Law Firm does not provide PASS-plan preparation, filing, or representation. If you would like personalized assistance with a PASS application, please contact an independent PASS specialist, your state Vocational Rehabilitation office, or a disability attorney who advertises PASS experience.

Contact Us Today For An Appointment

Frequently Asked Questions

What is a PASS plan?

A PASS (Plan to Achieve Self-Support) is a Social Security program that lets SSI recipients set aside income and resources to pay for work-related expenses—like education, tools, certifications, or transportation—without reducing their monthly SSI benefit.

Who qualifies for a PASS?

To qualify for a PASS, you must:

- Receive SSI or be able to qualify for SSI through PASS.

- Have a disability or be blind.

- Have income or resources to set aside (e.g., SSDI, wages, assets).

- Have a clear work goal that can lead to self-support.

Does SSDI alone qualify you for a PASS plan?

No. SSDI by itself does not qualify you for PASS.

However, SSDI can be used as the income source to fund the PASS, which may make you eligible for SSI — unlocking PASS eligibility.

What expenses are allowed in a PASS plan?

Allowed PASS expenses include any cost directly tied to your work goal, such as:

- Tuition, books, certifications.

- Tools, uniforms, and laptops.

- Transportation to work or school.

- Business startup costs.

- Assistive technology or job coaching.

How do you write a PASS plan in North Carolina?

To write a PASS plan, complete Form SSA-545 and include:

- One specific job goal

- A step-by-step timeline with milestones

- A detailed expense list with vendor quotes

- Proof of funding (SSDI/wages/resources)

NC residents can get free help from WIPA counselors, Vocational Rehabilitation, or a PASS Cadre specialist.

How long does a PASS plan last?

Most PASS plans last 18 to 48 months, depending on the work goal and required training. Shorter plans are typically used for equipment-based goals; longer plans are used for career or degree programs.

Can a PASS plan be changed after it’s approved?

Yes. PASS plans can be modified if your expenses, timeline, training, or work goal change. You must submit updates to Social Security so they can adjust the plan and continue excluding the income/resources.